Meanwhile, a subset of the sharing economy has been identified, called the 'gig economy'. This attempts to describe a world where people work for themselves either in one place or across many, trading their services on either a part-time or full-time basis. This in turn has led some to predict the demise of the conventional employment set-up of permanent employment and a job for life giving way to micro-entrepreneurs and self-employment on a solo freelance basis. A recent example from the US asserts:

'Gone is the era of the lifetime career, let alone the lifelong job and the economic security that came with it, having been replaced by a new economy intent on recasting full-time employees into contractors, vendors, and temporary workers.'

There are no direct measures of employment in the sharing or gig economy, so to determine whether or not this is the case, we have to rely on indirect or proxy measures. For example, we might expect a significant increase in gig-style employment to be associated with an increase in multiple job holding, self-employment, declines in average job tenures, more working from home, and fewer permanent employee jobs.

A look at the data

The latest labour market statistics published do not entirely support the 'gig economy' thesis. Over the past year self-employment, temporary work, and multiple job holding have all fallen as a share of total employment, while most of the growth in employee jobs has been full time and permanent.

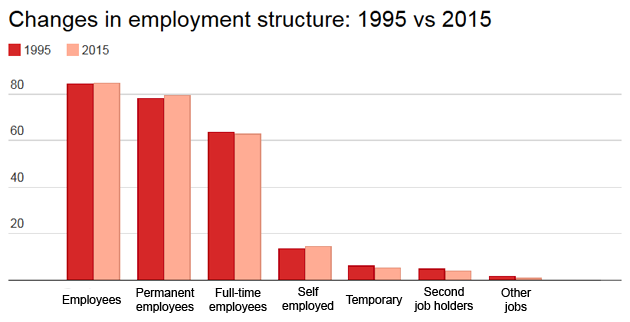

Similarly, longer run trends do not suggest a profound shift in employment. The chart below shows the change in employment shares between 1995 and 2015 from the household Labour Force Survey.

Another indicator might be an increase in working at home. Here the evidence is mixed. A recent Office for National Statistics analysis shows that the share of people working at home for at least 50% of their time has increased since 1998. The ONS estimates the 'home-working rate' for employees went up from 3.6% to 4.8% of the workforce, with most of the increase occurring before 2009. The self-employed home-working rate increased from 7.3 to 8.8%.

Other estimates published by Eurostat for the UK over a similar period shows that employees who said they usually work at home increased from 1% to 1.7% comparing 1998 and 2014. Occasional working is much more common at around 19% of employees in 2014 but the trend since the 1990s has been essentially flat. Overall, it is hard to avoid the impression that we are looking at fairly marginal changes in home-working as a share of employment with little sign that the trend is accelerating.

Percentage of employment. Permanent employees are total employees less temporary employees. Second job holders include self-employed. Other jobs are unpaid family workers and government training schemes. Source: Labour Force Survey, ONS August Labour Market release, The Work Foundation estimates.

Rising job tenures

Job tenure measures tell us how long people are staying with the same employer, so are probably better described as measure of the duration of employment relationships. OECD estimates show that average job tenures have been increasing not falling in many OECD economies, including the UK. The upward shift also appears to be happening across most age groups, so it is not the case that we are seeing a divergence between older and younger workers. Some of this must be cyclical, but job tenures were on the rise before 2008 suggesting an underlying structural shift in favour of longer, rather than shorter employment terms.

The most promising area for evidence on the gig economy is the rapid increase in self-employment that we saw in the UK between 2010 and 2014 including many low-income part-time self-employed jobs. This would be consistent with more people earning modest sums of money from engaging in sharing economy activities.

But the ONS has shown that the rise in self-employment was driven by fewer people leaving it rather than more people entering it. And, as noted above, the more recent trend is downwards. In a study colleagues and I will be publishing later this year, we show that the share of self-employment among the young has increased since 2010, but by less than for older workers. And even today it accounts for less than 5% of employment for the under-25s.

The case for the gig economy

There is case for the rise of the gig economy, however, which we should not dismiss out of hand. One is that it is too recent a development to show up in the aggregate figures – especially in the UK where it is less well developed than in the US. It is the future, not the present. This is unprovable one way or the other.

But the US data is if anything less helpful than the UK data. Economists Jonathan Hall and Alan Krueger have undertaken one of the few studies on employment in the sharing economy looking at Uber drivers and in reviewing the labour market context their conclusion is clear:

'The US surely has serious labour market challenges as a result of rising wage inequality and stagnant middle class wage growth, but these problems appear to be independent of the growth of contingent and alternative working relationships, as there has been little noticeable growth in those working relationships since the 1990s.'

The second challenge is that conventional statistical measures are not good at measuring new forms of work emerging on the margins of the labour market. As a result, some rather wild claims have been made about the 'real' extent of freelancing and contingent work in the US encouraged by the absence of up to date US official statistics (the last authoritative analysis was in 2005).

We should however take much more seriously a recent article which cites current work by Krueger and Larry Katz looking at tax returns (which would typically be filed by gig economy workers). These are said to be on the rise. Katz has suggested that these workers are less likely to say they are self-employed or hold multiple job in response to household surveys. This is a work in progress, but even if confirmed Krueger and Katz have said it is likely to be small as a share of the overall labour market.

The recent experience with the measurement of zero hours contracts in the UK certainly suggests some under-measurement is possible – though it should be remembered that even on revised estimates, zero hours are still a small share of overall employment.

Balance of evidence

The balance of evidence to date shows that predictions of the death of the permanent employee job are premature. The sharing economy has not, so far, changed the structure of employment and it would require a sudden and unprecedented shift which reversed very recent trends for it to do so.

One reason for this is that is remains such a small share of GDP. Predicting its growth is difficult, but accounting firm Pricewaterhouse Coopers has suggested a total market worth of about £9 billion in the UK by 2025. Assuming similar growth between 2015 and 2025 to the previous ten years would make this a share of less than 1% of GDP.

The business model pursed by some of the companies involved does raise some important labour market issues, not least the distinction between employees and dependent self-employment, the responsibilities of the providers of online digital platforms, and the impact on employment in conventional businesses.

One promising area for future research is how these developments might be changing the nature of self-employment, including the rise of freelancing and micro-business formation, especially in digital and creative sections of the economy. These areas may provide a more constructive and realistic agenda for debate and discussion than the unproven assertion that the sharing economy represents the future of work for all.

![]()

This article first appeared on The Conversation website. Image courtesy of Matt Warner, CC BY